A lively discussion with Pat Duffy, the co-founder of The Giving Block about where crypto philanthropy is and important lessons from 2021. Is it time for your nonprofit to start accepting cryptocurrency? What are the questions and issues that might come up? We discuss the topic in depth.

Data from 2021 in Crypto Philanthropy from The Giving Block

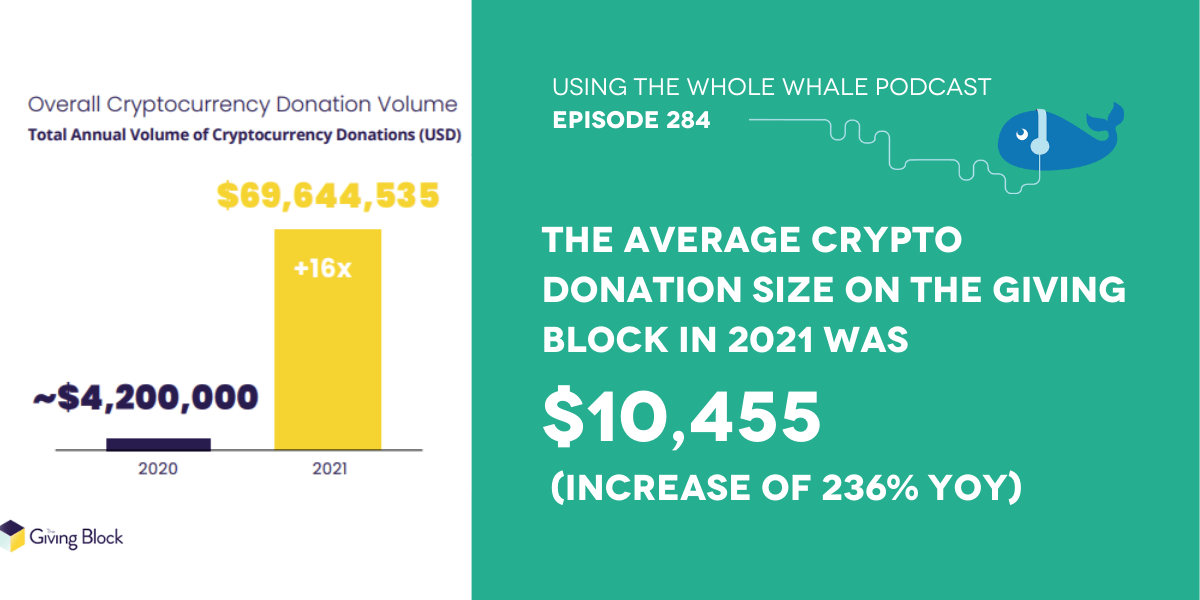

- The total donation volume on The Giving Block in 2021 was

$69,644,535, an increase of 1,558% from 2020. - The average crypto donation size on The Giving Block in 2021 was

$10,455, an increase of 236% from the previous year. - NFT projects donated $12.3 million to charities via The Giving

Block in 2021. - Crypto donation volume increased every single quarter in 2021.

- The Giving Block’s Cause Funds (index funds for crypto

philanthropy), established in November, raised $418,200 in their

first two months. - The Giving Block’s Crypto Adoption Fund (a mission-agnostic index

fund for all pro-crypto nonprofits on the platform), established in

November, raised $444,700 in its first two months.

Transcript

George: [00:00:00] Well, we have a returning guest, the one and only pat Duffy co-founder of the giving block. And pat, welcome back also, I’ll disclose we’re enjoying our work with you over here at whole

Pat: whale has gone. Okay, great. Thank you for abdomen. Your, uh, your voice just got a lot smoother when you started the recording.

You

George: know what I realized if I start in my, and like, you know this after listening, uh, my pitch giggle, um, which frankly I in, I could edit it out or the more energetic people have a hard time catching up to speed, but don’t worry.

Pat: It’ll come back. Yeah. It’s like when you walk up behind somebody, can’t start a full volume.

You gotta use a man. He’s got he’s

George: people into it. I think similar watch this smooth transition as into. You can’t have a hard transition. People think it’s something foreign and foreign is scary and unknown. And so I [00:01:00] like having you on to kind of go through the world of where we are in crypto philanthropy, uh, what we can expect.

And we’ll play today a little bit on some devil’s advocate, which I have some fiendishly

Pat: clever

George: now, not that clever, but very, very worrisome maybe questions that. Are being discussed at the executive level in boardrooms about whether we make this leap in to crypto and accepting crypto donations. So to start, how did 2021 go

Pat: great, better than a better than we expected?

Yeah, going into 2021, we had 120 non-profits. We had raised, uh, millions of dollars in the month of December for the first time. It was very exciting for us, the platform like we had raised about that much, our entire history combined. Um, so amazing out of year in 2020, and then, [00:02:00] uh, beat our end of year in January, starting January, 2021.

Which we found super surprising. I should say we beat in Q1 in January. Um, Q2 B Q1, Q3, Q2, and Q4 was explosive end of year non-cash asset giving as usual. Um, so we ended up raising about 70 million on the platform, like the crowdfunding component with the charities we work with on a contract basis. Um, and then in terms of like DAF partners, the behind the scenes institutional adoption of.

Saying like the, the biggest staff that we work with now, um, did almost $400 million in encrypted and nations on this larger kind of high-end, but behind the scenes. Um, so we’re building out an annual report now trying to figure out what happened last year. We’ve got the numbers coming together. We’re trying to figure out if it was like, just over, just under, uh, like a billion dollars in total crypto giving from this handful of.

Crazy billionaires, are [00:03:00] it around nine figures? And then these big institutional platforms that aren’t as out there with their stats. Um, but we’re pulling altogether, but long story short, really big year. So across all

George: platforms you’re trying to aggregate

Pat: or just through your pipes. Yeah. These are like, uh, in general, like when we talk about numbers, there’s like, I guess three different layers there’s outside of us.

There’s institutional, but using our pipes and there’s crowdfunding. I don’t think it’s a, I think a lot of platforms will fumble in institutional giving for like charity crowdfunding stuff. And they think that’s like a big pie that everyone is getting an equal, um, shout out. But it’s not really like if a donor connects behind the scenes with a donor advised fund account, it sends a hundred million dollars somewhere.

Like that’s not the same as like what you can get on a giving Tuesday. So would like to separate those numbers out. So institutional explosive growth. The crowdfunding piece, like the charity contracts, which is our bread and butter and platforms built on, um, 70 million bucks outpaced our client growth.

So we went [00:04:00] from 120 clients to over 1200 by the end of the year. And the average program size still increased, uh, despite a 10 X client base growth.

George: I’m really interested in that idea of the distribution across a number of nonprofits because in my mind, We’re still in a very much winner take all environment.

And my instinct is that this is probably an extreme parallel meaning that there are probably some favorites of crypto philanthropists and donors saying like, I want it all to go to the, you know, the charity waters of our group. And that’s where most of the money goes. Is that what’s happening? Are you seeing more of a longer tail

Pat: district?

No, because of the way we do business, I guess there’s two main reasons. One is we don’t do a donate crypto button one. We think that’s a really silly way to tackle a nascent fundraising area. So just passively [00:05:00] slap a donate crypto option on your site and not attack it as a donor demographic. There’s just too many donors using this stuff.

There’s too much money out there. So every client we work with, even on the lowest end there’s. Active strategy. Um, even if it’s just using collective resources. Um, so as a result, just like in general, five figure programs are the norm. And we’re about to have 200 programs that are six figure plus. Um, so like the answer is now, it’s not like all I ran at the top.

However, there are some, like, of course rockstar performers, even within that 200 organization, what’s that six figure. Plus when you get into the. Um, the seven figures and you start seeing these programs that are really crushing it at the top that are non-institutional. They’re like getting this from mostly new donors.

Uh, these are groups that have like a crypto fundraising identity. Um, they’re, they’re targeting crypto users throughout the year. They’re building a crypto specific end of year pillar that bakes into their campaign plan. Um, and then they’re carrying those donors with them [00:06:00] year over year. They’re not like trying to get a crypto donation and then shut the valve off.

Like they’re stewarding people in a crypto specific. On an annual basis. And every attention is definitely year over year, um, meeting them to kind of ramp their programs really consistently. So if I heard right,

George: what you did last year, essentially equates to what you did for the past four years back of a napkin?

Pat: Pretty much. Yeah. It stayed, uh, in keeping with that, just in the sense that like, we didn’t see this big. Tipping point where suddenly the nonprofit have been with us since 2018, we’re just breaking it all in and the newbies couldn’t get ahead. Um, we’ve still got, you know, hundreds of nonprofits that just came through right at the end of the year, and they’re still just getting their feet wet.

Um, but any nonprofit that’s, that’s been with us for a year for the most part has a five plus program, like almost universally. And then for the folks that don’t, maybe we work really hard to make sure that’s a consistent result. Otherwise you probably should. Fundraising grip. That would just [00:07:00] be a bit of a distraction.

Talk to me about the

George: sentiment at a nonprofit and would, it’s hard to archetype, but one that if I threw, you know, if I threw the dart, I’d hit the median, uh, not the one making six figures that turned on crypto as a donation vehicle last

Pat: year and

George: how seriously they are maybe now taking it or. Contrary being like set it and forget it, leave it in the corner.

I don’t get it. Money showed up. Like, where’s the sentiment and understanding of like, Hey, there’s more money here.

Pat: Cool. Yeah. Um, it is interesting how nonprofits ever respond to this success? It’s almost never the latter where it’s just like, oh, we’re getting free money. Perfect. Like let’s not pay attention to that.

And usually when you get a new, yeah, a new revenue source, like when you, when you have this. Uh, you know, diversified revenue pillar. You’re like, okay, we should probably [00:08:00] maybe pay more attention to this. It’s usually the opposite. It’s a big narrative. We fight in general just because every other payment method, it looks that way.

Right? Like no one is going to their gala and being like where my stock people at. And you’ve got like a table in the back. They’re like, yes, like this is so fun. You’re taking stocks. We are stock guys. Like it’s kind of. You know, wings over Walters from MDI and kind of think of, maybe it looks like that, but, um, there’s no identity, there’s no donor demographics, other payment methods.

So it’s, uh, you have to like reverse engineer, um, how we have that conversation with the nonprofits kind of build it back up from scratch. So it’s usually the opposite. There’s a handful of small, deliberate nonprofits who still sign up with us first other platforms, but they’re more like take the headaches out of crypto.

Otherwise they would just go like, try to find some Shopify for cryptocurrency, just plug something in or pass. Um, but most of the groups are coming and trying to fundraise crypto acts. They know what they think that is because usually different from case to case. Sometimes they like try tweet, nothing happens.

They shut it down for a few [00:09:00] months and don’t pay any attention. Now, when they get to your point, you know, a $10,000 dollar crypto donation that comes in out of nowhere, they’re usually a little too, uh, jacked up and they kind of go in an ebb and flow. They’ll spend the whole month trying to figure out how to tap into crypto users on.

And then get frustrated and disappear. And so the month of December, so, um, we’re really focused on like that year round consistent, like, let’s look at how you fundraise. What’s the low hanging fruit. Maybe it’s a major gifts program you work on internally. Maybe you have a big Twitter presence. Maybe it’s a corporate giving angle for like an event series that you have, but, um, starting with whatever is most conducive to you being successful.

Um, and that’s usually what, what ends up. Yeah. I mean, given

George: that mass majority of depends on when you’re listening to this of Americans do not have a crypto wallet or the capacity to give I’d imagine most strategies revolve probably around more of the high net worth mindset, potentially of what it looks like [00:10:00] to consider, you know, capital level gifts or a significant level of gifts versus, you know, donate a dollar.

Don’t worry. The gas fees are 50 times

Pat: that yeah, no, it it’s a. Blend. It depends on the organization. You are, there are some big institutions, you know, like a, a big university that’s in the bay area or something, um, versus like a crowdfunding nonprofit that builds animal shelters and has a popular YouTube channel.

Um, depending on what kind of a nonprofit. You’ll see some, non-profits taking the millennial gen Z traditional fundraising approach, but targeting crypto specifically because they consume a lot of content. They’re younger on average, they’re, they’re energized by that. And they’re looking for a place to get together and have fun.

Um, so there’s these young donors, but then you also have like so much wealth held in these handful of hands where they’re just hyper incentivized to get this way. And then other folks are just building out like a major gifts, uh, packet, and then they’re delivering it to these wealth advisors. [00:11:00] That they’ve built a network up, uh, you know, over a decade.

And then they have this handout that goes to their use every year to make a donation. Now they’re like making this crypto option node and they’re turning, you know, a $50,000 donation into a $5 million donation, a handful of times, because they’re finding that big hit for this one person has like a hypertext sentence, get just this way just this year.

Um, so like, it really does look totally different from charity to charity. I was like how you fundraise and what your existing program. And then it depends on, um, you know, ROI, like what is the energy? It could look like for a non-profit to figure out Twitter for the first time, just to get a crypto donor base.

It’s like, if that’s where you’re figuring out sweater, it’s probably not the best place to start. I mean,

George: let’s pull on that thread. There seems to be a unique difference between classic donor communications. The typical

Pat: donor, a nonprofit has

George: right now versus the crypto donor, the crypto philanthropist.

And that might. What are

Pat: [00:12:00] the,

George: I’ll give you three points. What are the three differentiating points that you’d say, like, if I were to have, you know, two people hide behind door number one and door number two, and you can only ask them these questions. Like what would those questions be to figure out which was honor or what would be the way that you’d be like, those two are very different people for these reasons.

Pat: How dare you arbitrarily restrict. Without, without having a prepared response there. I’ll see. I’ll try to keep it tight, I guess. Maybe you’re trying try to insinuate something, uh, about the length of answers. Uh, generally speaking, um, you know, there’s, uh, the demographic pieces, right? They are, um, younger, late twenties, early thirties.

They are tech savvy. They’re financially. Yeah. There are impacts motivated. The fidelity report came out this past year. If you are a crypto user giving through their DAF, or you are a stock investor, a crypto users are 50% more likely to give a thousand dollars or more. [00:13:00] Um, so it’s dramatic. Like they’re, they’re more, impact-driven partially probably because like they’re on this cutting edge technology and they’re getting a rush out of it.

Like these early refusers, especially are kind of attracted to it for a particular reason. And then once it goes mainstream, maybe they’ll move on to something. So you have this innovative, younger tech savvy audience, they use, uh, you know, Twitter, Reddit, more kind of modern social media and search engine functionality than you would expect.

And then on the high end, um, they’re probably, you know, motivated by gains. So like if you’re trying to, I guess, um, figure out if someone is a crypto user or not a crypto user to your original question. And you’re trying to ask some, a couple of questions about asking them if they’re into a crypto, you’d probably want to know like how deep they are in technology.

You’d want to know like how financially literate they are. Like they would know about like index fund investing and other types of investment modules, um, depending on how diversified they are. And then just age is a thing. [00:14:00] If you look at 50% of millennial billionaires, have a quarter or more of their wealth in crypto already.

And I think that’s as a. 2019 is when that MSNBC, uh, big survey came out. Uh, that number goes up every year. So if you have a young, a wealthy individual who’s financially literate, tech savvy, um, a very desirable donor demographic, of course, the, the odds are every single year, more likely that they are going to be a crypto user and with almost 300 million crypto users already, um, it’s more than largely.

Now to, to be worthy of tackling. And every year that goes by, it becomes or incentivize and from the

George: demographic is first off, super helpful to know. And those listening right now, taking notes, being like, oh, I get it. So if I’m segmenting my existing audience, that might be an interesting place to start.

I’m now wondering, let’s say I’m a, you know, an [00:15:00] advocacy organization for ex. It seems like just if I were to map out the time between nine, our analogy here of a door, number one and door, number two, you have shown her versus the crypto donor, that there is a, almost a philosophical that leads to caring about different causes and prioritization of different causes than a traditional donor.

And maybe that’s unfair because like I’m using the word like average donor that gives across the. Education to animal welfare, to, you know, advocacy, to gun rights, to, you know, these classic pieces. It has seemed to me early on that there are different causes that maybe come to the top of the list, or even the framing of what you do at your existing organization that might appeal more to door.

Number one, our crypto donor versus door. Number two,

Pat: our classic donor. Yeah. Uh, good news and bad news. [00:16:00] I guess on that question. Um, the bad news is it’s not a consistent, I guess there there’s no, as far as we can tell, um, big ideological differences between them because you, you get this blinded older crypto users tend to be more libertarian than I guess, conservative, but this is just for like basic polling.

So you’ve got the conservative aspects of conservatives and from an economic standpoint, but not on social. Um, and then younger folks are, you know, younger folks, they’ve more predictable patterns, but they go across kind of the same areas that are popular across the nonprofit sector. Um, so not like a big gap.

It’d be nice if was just like, just environmental groups are crushing it here, everyone else, like they’ll pay attention and environmental groups. Like it’s a must have, like, you have to just do that when we can just like focus our strategies on that. That would be our, our client base. It seems to be general donor behavior [00:17:00] to go across other like age seems to be a better indicator than the crypto piece terms of what they choose.

However, in terms of conversion rates, based on those organizations who they end up choosing and actually give to the biggest differentiator is just like making a space for them. Um, by that, I mean, nonprofits. Uh, there’s a difference between adding a donate crypto option versus saying you have a crypto fundraising program and you’re going to set a crypto specific goal.

And every $10,000 you’d given cryptocurrency builds a house or puts a kid through a clinical trial. And then the graphic on Twitter shows how much crypto users have enabled their nonprofits mission over this year. And this is the page where you can donate crypto. And here is our crypto specific milestone toward a crypto specific goal.

That’s kind of it, you can think about it almost like, like culture versus follow culture, which we talk to our clients about a lot. Like if you’re trying to fundraise, when we do our big end of year campaign, like the bag season stuff that we do in crypto giving Tuesday [00:18:00] off the giving Tuesday foundation, if you’re going out there and you’re looking for likes slash looking for donations, um, that’s, uh, inferior strategy to looking for follows slash looking for donors, right?

People. With the mission and find a place where they go, I want to give, and I want to see where this thing goes, if you like the cause. And if you’re part of the crypto community, so you’re probably super into crypto, it’s your culture, it’s your life. And you wake up and check your social media. Like that’s the kind of concept and you’re looking for.

Um, people are into it are very, and so people know that you have a friend who will shut up about it. Um, when those two things get birched, uh, donors go, okay, I’ll send a donation to this thing and I want to be a part of crypto communities. Um, this particular cause, and I want to know what people like me are doing to make a change here.

And I want to know when we, as community hit a certain milestone. Um, so yeah, just the, the nonprofits who make that space, small, medium, and large kind of, regardless of mission, they have the biggest impact. Um, even when more traditional [00:19:00] charities in a different sector seem to be getting. It’s helpful because

George: I think it can be similar to the way we look at, you know, how credit card processing back in the day made its way onto the internet and people who said, oh, you need is a donate button.

And it was like watching that come in and then mobile, mobile coming over and me, like, you have to make sure your, your mobile web experience can, you know, what a render so that someone can give on a phone who would ever give on a phone. That doesn’t make sense and like, oh wait a minute. Absolutely. This is uniquely different because you’re not just saying, Hey, you know, by the way you need the technology, we’re not even at full, near full adoption to be clear near full adoption for non-profits accepting cryptocurrency and safe, reliable ways, but more so you’re saying it

Pat: has to be paired with.

George: The actual ask the campaign, the unique, this is the crypto side of our target versus like throw it into this giant bucket. It’s almost like the community wants to see. And you could imagine [00:20:00] even compete against the Fiat you like last year Fiat be crypto. What do you think of that crypto?

Pat: Yeah. We’ve been seeing more of that with stocks too, when they have these kinds of wall street campaigns, because the youngest stock stocks, it’s pronounced stocks number, never go down.

Um, that’s funny, but yeah, like they’re doing these competitions cause like these, uh, it’s the same. I mean, if you George, no, just cause you’re you’re into crypto. Like you just, they do it as a technology. Like it’s the same thing with wealth advisors where it’s like. They’re not getting into crypto. It’s like 95% of hedge funds.

Now either have crypto or they’re diversifying intimate banks, or like putting capital into a company’s treasury man. Like everyone’s getting into it. Not because they want to, but because like for wealth management, for instance, eventually like grandpa is going to pass away. And the person who gets that money is like exponentially more like.

To be diversifying into [00:21:00] crypto. And if you’re like a wealth advisor, you’re not like really up to speed on all the crypto stuff they want to do with that billion dollar pile of money. Like you’re out, like the Capitol is moving off platform like wealth advisors are scrambling for that base. Um, anyway, back to your question, though, in short non-profits are doing the same thing where they have like these wall street type campaigns, a lot of our New York, um, profits, their gallows, whatever else it is, but like the younger wall street.

They’re like working on stock related stuff for companies that don’t do anything if they’re related, but like all of their money in their paycheck is going into like crypto in NFTs. So now they’re trying to engage the younger crowd that’s coming through these wall street specific type initiatives, campaigns, advisory groups, and they’re using crypto is like this incentive to like, get those sorts of younger folks onto their boards or engage with their fans or just driving in more donations.

And same thing with universities, right? That’s how they set the hook. Every year. They’re graduating a class of 22 year olds every year. They’re obviously dramatically more likely to be throwing their money into crypto and have a big tax set up to give the [00:22:00] appreciated crypto instead of their cash and their stocks.

So it’s a great way to set a Hawk and establish like a giving relationship. Um, it’s very much eyeing toward like where’s the next generation of donors going and are we going to be in a position to be successful? I mean, you were

George: talking about the largest wealth transfer in arguably human history with the, you know, the generation of boomers passing on just incredible consolidation of wealth into this rising generation who you have already identified.

And based on many, a poll are, you know, leveraged in at 25% increasing, depending on who, where and how saying like, yeah. So that is a percentage of my portfolio and there it goes. And part of my giving. Identity is giving via a crypto, which, you know, we talked about our last podcast has significant tax advantages because, uh, you do not have to bring it into a taxable event, into Fiat and then make the dimension.

You can simply transfer it right then and there, uh, [00:23:00] you know, pretty

Pat: seamlessly. Yeah, that’s, that’s pretty much the whole thing. It’s the same reason why non-cash assets. It’s so gigantic versus credit cards. If you can give a million dollars in cryptocurrency, right? And then it would have been in the real world or 700 grand pay state and federal cap gains taxes, and it could be worth a million.

You can give the full million to a charity and you can take the million bucks in cash. We’re going to donate and just buy new Bitcoin or whatever else. Um, you end up with the exact same crypto position, but it’s at today’s cost basis. You literally know, or own no taxes. So there, you got your million dollar write off and you.

300 grand at capital gains taxes. If you try to tell that person to not give that way, it’s pretty hard to earn their business. Yeah, that

George: makes a lot of sense. I want to touch on something that might be a touch, more esoteric, but I see quite a bit in the crypto space of the rise of, uh, [00:24:00] decentralized autonomous organizations Dows and various NFT projects, non fungible token.

And in that ecosystem, it seems like one of the new marketing mechanisms, the gimmick to buy in gimmick reason, motivation is impart X amount of money is going to go to charity. What is your thought on one from the perspective of a nonprofit? How do, how do I get some of that please? And.

Pat: To how

George: does giving block potentially pay into this broker, these relationships and

Pat: work in this sphere?

Yeah, NFTs and Dows were like a big growth area for us last year, NFTs in particular. Um, just to explain it, people were donating crypto from NFC proceeds like 95% of the time. So we called it like NFT related fundraising. It’s coming from NFC creators, projects, platforms, artists, et cetera. All crafted, but like millions of dollars a month now, and donation going from [00:25:00] the NFTE community, which is super cool and a Dallas or a bit of a rising stars.

There’s two angles on this. There’s, non-profits creating Dows, which they’re starting to do a little bit. We end up as a firm being more of the fun police and like the, the unlocker of dreams, which I know is not fun to hear if you’re like just getting into crypto and you want to go deep for six months.

Um, yeah, I think, uh, one interesting one that’s being explored is, uh, I guess WaterAid, uh, Over there. Who’s electric. She’s done a lot of really innovative crypto fundraising stuff. So shout out to her, but she’s, she wants to start one called system of a Dao, which is hilarious and like incredibly thoughtful, um, the way she has it put together in short, it’s pretty much like, um, you know, there’s this contractual element where people can participate in the system and they all kind of get a say in where it goes and what it does.

There’s a assessment of governance. That’s more Democrat. Um, and then the capital that goes into these [00:26:00] systems can be distributed outward in a predetermined. When I say to a nonprofit, uh, the way we work with them is a lot less complicated than I think people think they just pretty much need a, you know, a wallet address for the under symbiont so they can build into their contracts.

And then in that case it would be a nonprofit. So they tend to come to us to tell us what sort of thing they’re into, you know, we’re into the environment or, or to social impacts, whatever it might be. Walk us through these different non-profits on your platform, or let us use one of your index funds slash corresponds to like build kind of a bundle that we can send one transaction.

So, and you just hook it up to the contracts at the end, and that’s where the, uh, the crypto ends up.

George: I’m wondering what phase two of this looks like. If you follow me that when early stage, you know, web one to web two non-profits the sector in general was like, how do I get a donate button on this? And then how do I get money, money, money from this?

And then they realize, oh wow. We can create things. Like, I [00:27:00] don’t know, donors choose. Classrooms and innovative ways and Kiva, you know, uh, well-known darling of, uh, just how you can deploy micro finance, uh, in incredible ways across the world. How, how long do you think it will be before we realize that this is more than just another donate button for the sector?

Pat: I think we’re more or less getting there. It’s funny at the high end of the sector, it’s already kind of. A done deal. Like we’re, we’re getting close to a a hundred organizations. This is faith-based organizations, universities charities, healthcare networks. They get any 5 0 1 C3. Um, we’re we’re about to pass a hundred groups that are nine figures plus.

Some 10 figure organizations. So like the big players are tapping into this pretty effectively, but they had big teams, red, Dave innovation budgets. They get to things first, usually. Um, but they’re really doubling down. Like we’ve seen the St. [00:28:00] Jude save the children, American cancer society United way worldwide take.

These are all organizations that came to us after having fundraised crypto on their own for a multi-year period for the most part. And they’re like, let’s build a program now rather than have a button. They kind of set the pace of play and because they’re leading and building like pretty serious programs and getting donations for notable people in companies and partnerships, that’s a big driver.

Um, but ultimately, like, I think a lot of this is going to come down to the degree to which John Cash asset giving becomes popularized across the actual software solution. So like a lot of nonprofits getting trapped because of the integrations they end up with. Will not name names, but there are some platforms that have D you know, they’ll take like a bit pay or like, you know, any equivalent Shopify for cryptocurrency.

And they’ll just like plug it into a donation, Gabe. And of course it wreaks havoc. The average crypto donation is $11,000 on our platform. The average credit card donation is like usually 110 bucks, 120, whatever report you look at 1 [00:29:00] 28, maybe it was the most recent one. Um, like don’t send those people through the same process.

Obviously we get, non-profits ask us all the time, like let’s set up a monthly giving options, like. We talking about it’s like, why would you, you got 20 bucks a month. If you want $11,000, like this is a tax offset opportunity. These people need to be treated differently. So I, I think unfortunately, a lot of charities will interface with crypto for the first time they were like a non crypto specific, um, or crypto philanthropy specific, um, process, which is a bummer because they’re like we put this on our side for a year and nothing happened.

I guess crypto is stupid. It’s like, Not necessarily trillions of dollars in it, people are doing all right. Um, so that’ll have to add, so ultimately the, the service providers will need some sort of like, you know, a Stripe equivalent to emergence of crypto becoming a normalized part of that process. Um, and then that process is obviously going to have to accommodate a new donation method effectively.

So people coming in and picking say their donation [00:30:00] method first, and then being stewarded differently instead of having. Go through a traditional donation process and then picking a donation method at the end, regardless of the tax implications, are there their underlying reason to pick whatever that payment method might be?

I think we’ll, we’ll hopefully invert is non-cash asset giving becomes easier to do, and then therefore more popularized because it’s in, I mean, you notice, but the math works out. It’s just as easy to send crypto stocks. They would literally be. Cash giving. It’s a silly thing to do. It’s as crazy as like you’re going to pull out the asset

George: experience the, uh, the tax event and then make the move.

Pat: You gotta eat a big bill for no reason. Every time you, you don’t donate non-cash assets. So it’s up to the industry to, to make that process available to donors and education, um, as important as well.

George: I personally only donate.

Pat: Yeah, it’s a size of corn. C’mon hard commodity shout out to, to write us out as charitable, making it easy for all the [00:31:00] craziness assets.

I want to

George: just reiterate this really quickly because one of my agenda points here was trying to separate the way you talk to the way you experience, the way you strategize around. A Fiat owner versus a crypto donor. And I think I isolated net one statement. I just want to make sure it doesn’t get lost wherein you’re saying that if it’s just the one page, donate everything you want here, one of the things you’ve done is anchor them to an incredibly low price

Pat: of like, Hey, we’re

George: looking for a hundred dollars.

You’re not, you’re looking for world changing amounts of fricking money

Pat: to do your job. Now

George: let’s talk about what you. And you want that experience on a crypto focused narrative page layout set up, which you know, is evolving and has to be customized to your message, what you’re trying to achieve, blend it over with what you know, you can discern about what that Venn diagram and the crypto mindset.

Pat: Yeah, that’s it. We, [00:32:00] we are the fucking police for the most part. We get so many charities and they come and fall and we just killed their dreams. They want to sign up with us because they want to do, like, they’ll see like our NFC drop with Sotheby’s or something. And they’re like, let’s do an NFT drop. And I’m like, we have to search engine, optimize your page for NA where’s my punk.

Where’s my, every punk

George: just gave us their punk like great idea. Excellent idea.

Pat: What is.

George: It’s very

Pat: early days and killers. Yeah. We were coming to like jazz heads in 2018. We were all jacked up and they were like, yes, like no one was buying in. So we were like, we’ll do anything. And like, when they wanted to do creative stuff, we’re like, let’s do it.

Let’s do it. All right. Now tell us so much more. It was way more fun and exciting and, and dramatically less. Um, but yeah, you, you nailed it. Like the user experience all the way down to like that call to action. And like that call to action has a link to it, which is a donate crypto specific page with a description that actually [00:33:00] works for that person as in the thumbnail that applies to them.

And it’s like, okay, now that image is drawing the eye. And when you get there, like there’s actual language around the tax portion of this and the FAQ is necessary to create a conversion and then they have the resources they need. If they want to give something to that. In whatever your solution is. So they have that roundabout way to send that like low and mid cap crypto, and it all feels seamless.

It actually gets done. Like there’s just a lot of volume trapped in a very complicated process that I wish we could put on a bumper sticker. Um, but thank you for drawing attention to that and helping I have one

George: more, uh, question now I have two more questions, one donating FAA, uh, and FTS. That’s a thing.

Now we can donate NFTs.

Pat: So non-pro have to be this

George: tall to ride the ride or not a scam to ride the ride. What?

Pat: Oh yeah. It’s the scam part is actually not that big of a concern. Um, again, if these using crypto, this is a big misconception of crypto also like there’s 10 X, less elicit activity per [00:34:00] capita, encrypted than traditional finance.

So like the media loves crypto scams more than regular scams because it’s, it’s got a Bitcoin logo and it’s just a little bit more fun. Um, But it’s just, it’s dramatically less likely to have an encrypted elsewhere. It just feels a little bit scarier and crazier. Um, so anyway, the NFTE piece yet, we haven’t had any concerns on that front unencrypt that we’re entertained, but we do have a lot of donors and nonprofits who don’t know the best way to give.

So like we get nonprofits going to donors or platforms like asking them for some NFTs and then the platform. Oh, okay. We can talk to an artist. We can like mend some, I guess, on behalf of the charity it’s like, and then we’ll sell them on the platform and then you guys would have the crypto proceeds.

It’ll go. I thought we could have them. And then we could do like a NFT gallery and they’re like, oh, I guess you, I guess you could do that. And the, we have to come in and we’re like, what are you. We need to get the money. It’s not even that. It’s just [00:35:00] like they have a good, like, it’s not that it’s a bad idea.

It’s just that when it comes to NFC philanthropy, there are an infinite number of ways that it could go. And again, 95%, I said this at the beginning, ends up with a crypto transaction to a charity at the end of what is an NFT drop that happens on a platform that already exists or not being minted by the charity, but the artist instead, and then the.

Come through and CryptoGoss bats when people are purchasing them with, and then that pool of funds goes to the charity and it’s all happening as a result of this amazing NFC movement. But it’s not like a bunch of NFTs are being given to a charity and of the charities, like holding them and creating galleries or, uh, like auctioning them off individually from an account that the charity owns.

And like they’re hooking up their own Medimap wallets to, you know, open sea or whatever else it might be. NFT philanthropy for the most part is the platforms where they go just like a crypto exchange work with a set of like Gemini gives day or whatever, just be a platform wanting to do like our NF Tuesday.

We did this past year where they’ll do a drop on [00:36:00] behalf of different charities or fellow profit movement or artists. We’ll all throw in as a part of a collaborative and be like all of our fees on this day. Like we’re sending them all to this charity that we all love or whatever it might. Most of them, that’s actually getting to the charity via crypto, but like the driving force in the impetus is at FTS.

However, whether or not if T is hyper appreciated and in the hands of one individual and they bought it for a thousand bucks, now it’s worth a million. And they’re like, I want to give this to a charity directly. And if I sell it, it’ll trigger a taxable event, then you have to take that. But there’s no reason that the charities individually need a specific solution to process that in-house we use pretty much, uh, we had one donor buys.

Partner that we’ve created a system for them to be able to process. And they just mastered that exact scenario of like how to process that. So it’s not like every non-profit that we work with. You know, we need 1300 nonprofits to develop a new set of Headspace, to like process these sorts of donations and answer those types of questions.

Um, eventually if it becomes so common that people are [00:37:00] coming through the interface and wanting to throw an NFT at a charity very consistently, then we’ll have to update the solution. And then also. FAQ is then also update the way the charities fundraise. And when they call for crypto, maybe they’re calling for crypto ad NFTE.

So they’re creating separate goals and standards. So like that could be on the horizon, but it’s not there yet. NFTs are driving millions of dollars every month in crypto philanthropy. Um, so it’s just, uh, an important distinction. Eventually there might be a lot of direct NFT transfers, but still very small.

Thanks for person through

George: that into, I mean, I love the details. Um, Alrighty. I want to move into a little, a little devil’s advocate of there are holdouts are quite a number of holdouts, whether intentionally or simply too busy. I want to just go through what might be in the back of the mind of an executive or a fundraising director right now.

Who’s like, you know, we gotta wait on this thing I heard it’s this, this, this, you ready? Okay. And you’re responding. You respond as you need to. [00:38:00] Uh, clearly it’s been seen the proof of work. I read it somewhere in a paper is incredibly taxing on the environment. It is basically a small country and order of operation.

I heard one NFT is like the amount of energy it takes for an American in a given month. That seems like if we’re going to participate in this, that it actually is, is, is hurting. The environment and maybe even a cause that were Jason to what say you.

Pat: Yeah, it’s, it’s a, it’s just like a logical fallacy, I guess.

It it’s interesting. Um, and perfect work needs to get more efficient, but it’s just, it’s a multi-varied thing when people look at in general, so people like want to know how bad is money for the environment. You have to think about all the environmental costs of. Right. Like, like what is the alternative?

So first of all, you have to like weigh them against each other. It’s very, we always say it’s very similar. Like when a Tesla, it’s a woman on a bicycle, especially like in the early days, people were like, we got to stop making these things and it’s like this shouldn’t we take 10,000 [00:39:00] driving hours of a Tesla and then take 10,000 driving hours of human beings and see if it’s either more efficient already.

If so, then we should only be making that money. If it’s not as efficient, let’s figure out like, what is the timeline for it to be. More efficient. Right? We should think long-term about like what that would actually look like, rather than just saying if there’s ever a risk with that technology, then that means we shouldn’t have it.

Um, in short is cryptocurrency that uses proof of work more taxing on the environment than the traditional financial system, I would say no. And if you make an argument that it is more taxing, like on a per transaction basis, the traditional financial system it’s so. Just to make it pretty arbitrary to say that, like you shouldn’t send crypto to a environmental charity, but you should send dollars.

Despite the fact that you have like an infinite series of skyscrapers from their conditioning and millions of cars commuting to, and from locations and burning billions of credit cards that end up in landfills and. The loan offices, you can go all across it. So like the, the infrastructural component, how much [00:40:00] energy it uses needs to become more efficient for sure.

But if you compare it to alternative ways to send money to a nonprofit, to say that it’s worse would be like a pretty close call. And if you can, like ethically say. Using dollars despite like the burden that they do on the economy, then it’d be pretty ludicrous to say that like a single transaction of sending a hundred thousand dollars to like an environmental nonprofit, because crypto isn’t as efficient as it should be means.

Like I’m not going to send that money to the nonprofit. It’s just a cost benefit analysis. If you’re sending, I guess like 5 cents or something to an environmental nonprofit over and over and over. Maybe not, you’re probably doing a net negative, but for like, non-profits that fundraising it’s just like, is the value of the money that you’re getting the crypto you received versus the environmental impact, the single transaction worth it.

And you’d have to be pretty silly to say it’s not at almost any level other than like a micro conation. I think

George: there’s part of the, the math, which I’ve [00:41:00] seen speaking as my devil’s advocate here. That is certainly you can math it both ways. Uh, in terms of the, what about ism of a, what about Fiat? What about this zoom call that you happen to use on Tuesday?

What about, uh, you know, the plane you had to fly in order to get to that last meeting? There are trade-offs and we have to make them in it’s a complex world, however, Is it also a problem that a predominant narrative with Fiat donors and supporters potentially is that if crypto then bad for the environment, for whatever reasons, is there an emotional threat to my organization by simply having crypto messaging coming from my main account, because guess what?

Who’s going to see it. Um, does the upside negate the potential emotional

Pat: risk? It’s a, it’s a choice that folks have to make, like whether or not being right is worth the argument. Um, it depends. It’s our fastest [00:42:00] growing charity demographic. For sure. Environmental groups are just giving crypto users and companies the opportunity to more or less, you know, offset the environmental impact.

Another big confusing variable is like not using crypto. Doesn’t make it less taxing on the right. The amount of energy it takes is to reconcile a block. It’s not for an individual transaction. That’s why the map is always throw. So like not throwing another transaction into that block or taking your, you know, throwing another one and it doesn’t change it.

The bigger the network becomes, the more people using any cryptocurrency, the more efficient it becomes because you’re processing using the same amount of energy, a larger. Is it so it’s anyway, it’s just a misconception. So a lot of environmental nonprofits just recognize that to not accept cryptocurrency, doesn’t help the environment.

And by accepting cryptocurrency, that means crypto ends up in your hands, which you’ve used for environmental purposes, which is obviously a net positive. So like, if you care about what it’s true, then they accept it. But you’re right in the sense that like, is it worth [00:43:00] like a PR issue or is it worth having this argument?

Even if we are right. Could it hurt our credibility. Is it worth the energy of having to explain to everyone how this actually works? Some people say no. Um, it’s still definitely our fastest growing demo because enough environmental organizations are like on a per transaction basis. This is clearly a net positive to which we say, come on, you know, water’s more, is there any fear

George: warranted on a warranted around guilt by association with potentially.

Uh, accepting a token that then gets revealed to be a scam, a rug pool or something like that. Well, this charity was accepting this and like, wait a minute. If our, if our door is open, anything can wander in. And suddenly, you know, you know, the Taluk is sending me a whole bunch of Dogecoin that by the way, is, is doing whatever it’s going to

Pat: do.

Yeah. It’s, it’s not a threat depending on how you set it up. [00:44:00] Uh, a really important thing we touched on earlier, which we should probably dig into a bit more is the way we set up every nonprofit is with an exchange account with like the most careful exchange in the U S so like the, the actual interface you’re using on your site and the direct donations you accept, and cryptocurrencies is a reduced less than the top cryptos that account for about 95% of crypto donations.

And then there is that 5% out there. There are seven figure plus donations that happen in these small and mid cap cryptocurrencies, um, that do require more through diligence and kind of a lookout. Um, so if you set up an account with like a, or if you even go directly to like a very careful exchange that you have that limited selection, now what happens are these one-off scenarios where if a.

A donor, a community of donors that are like building some new token or project come to you and they want to transfer about your tokens to you that are not listed on your exchange. Then what you need to do is like have a partner like ourselves. And unlike the folks who we refer to as experts, they’re pretty [00:45:00] much determined.

Like, is this a new token worth quote unquote listing? And won’t actually change the price. Should we accept it through, you know, our third party, um, that partner who can process complex crypto assets. And if the, you know, in triangulation, we all agree. It’s like, this is still like a top 100 cryptocurrency that doesn’t appear to be listed just because it’s not a priority from a volume standpoint, but it’s not high risk, then you would take it.

Um, and then if not, and it would be because like we, or the exchange or, or one of our partners would red fly it for some reason. It, again, Um, but non-profits, shouldn’t be making that decision in general. It’s just like, would you accept the stock? It’s like, that’s an S and P 500. Is that a question? That’s a NASDAQ question.

It’s not like up to you to determine if a stock is legitimately representative of a company. Um, like that should be done by legal and compliance folks. All right.

George: You don’t have to follow me on this one. Okay. What is the danger of. Saying [00:46:00] and maybe putting out to the community, uh, we accept Bitcoin would, which would be a natural message and an average Fiat donor coming and being like that’s so elitist, they only accept $37,000 donations because that’s the price of Bitcoin right now.

They only accept these like large units of money

Pat: that doesn’t happen. That’s never been a thought, how dare you? What you’re really asking is. Some nonprofits don’t know that Bitcoin is divisible, but you’re not actually worried that a donor would be mad at the non-profit because they think that God is not to visible and they’re calling them us.

Do you think that’s actually, there’s a bucket of second order

George: effects and one of them, and one of, if you believe that, no, if you believe in a poll that everyone realizes that actually this is a fractional currency system, um, divided on the blockchain. Like you’re gonna miss some people. Yeah, by the, the overall joke aside narrative saying like, is this mean like, oh, you don’t [00:47:00] need my money because you’re now this, you know, crypto accepting elitist or libertarian type of institution.

Pat: No, that’s not a thing. You could have a donor who doesn’t like crypto cur. But I think those people are relatively rare. You got a lot of people going out and get it. You know what I mean? Like early days of the internet where they’re like, what about the, the Google? You know, you get some of that kind of, I don’t think there’s a lot of anti crypto people.

You’ve got policy makers who are, who are paid to be more or less just because they represent different interests, but there aren’t a whole lot of individual sort of like against what it might be other than of course the, the environmental. Which is an unfortunate misconception, which is mostly funded of course, by third-party to benefit by that not being a thing, some being within our own, which we’re obviously aware of.

There are some cryptocurrencies that don’t use proof of work who love funding, those sorts of hit pieces and research papers, um, because it’s, you know, politically convenient. But now in terms of the fact that to answer your first point, [00:48:00] like crypto is divisible, you can send a dollar in Bitcoin anywhere.

And a couple seconds, if not, you know, a couple of minutes and you can also send a billion dollars anywhere in the world, a couple of seconds, if not a couple of minutes, it’s kind of what makes it awesome. Are one of many things. Um, I don’t imagine there whole lot of donors who will get mad because you accept something that has a high unit value.

I think it’d be similar. Like if they went to sentence stock and they saw the Tesla was an option, they were like, that’s a very high share price. I guess they don’t need my money. And it’s like, well, I mean, that’s just a stock that exists. I don’t know if your caricature exists, I guess, is what I’m getting at.

It’s a bad question. It shouldn’t have made it to the podcast,

George: not editing it out. You have an open wallet address. There’s basically the ability for anyone to send money into it or to send whatever it wants at a, at an address

Pat: as a nonprofit. No, Nope. Not the way we do it. That’s a great question. That’s

George: the difference then?

So if you just had an open [00:49:00] wallet, anyone could send you absolutely anything. And by the way, it would be public

Pat: and they could see every transaction that ever went into and out of that wall, which is also why people get confused. They think crypto’s like dark web plumbing, if that’s because it was in the early days.

Not because it’s hard to track, but because no one was tracking it because there were like 80 guys in their base. You know, trying to like buy missiles and just like, that’s all that was going on for like a little while. I, I, I made it more extreme as a bit foods, mostly. Yeah. People buying like mushrooms.

Um, so anyway, they’ve used a great form of money to use when no one’s tracking it because it’s a completely verifiable financial system that works perfectly. So you can take exactly now, like when money gets from position to position B, you don’t need any banks or intermediaries, great way to sell drugs online.

That’s it? People start tracking it. And then you realize it’s an immutable ledger and not one Bitcoin transaction has ever been changed since the origin of the technology. Literally not one book [00:50:00] cooked. So that means like the DEA quote or whatever, though. We love catching people with crypto. It’s like, when you find it with cash, you find their phones.

When you find them with crypto, you find their books and it’s like, yeah, if you find someone with a crypto, you can see literally every transaction that’s ever gone into route it. So if you are a public facing institution and you’re looking for radical. Transparency, you can pop one of the wallets off of our system, make it public, run a fundraiser, and then have a report and analysis on it.

And everyone can see in a completely verifiable unchangeable, immutable record. Exactly what went down. That’s a fun little experiment for your general fundraising needs as if you’re say a religious institution or, you know, whatever it might be. And you’re more private with your financial record keeping you want to use dynamic wallet addresses to generate a new one for each donor, which is our default system.

George: That you have an excellent job answering my questions from the rational to the ridiculous. Well done again. I think we all have to deal with, you know, some of the realities and some of the perceived realities. You did a good job narrating that. Thanks for spending a ton of time explaining all of [00:51:00] this.

How do people find you? How do people help

Pat: you? Yeah, finding us, uh, the giving block.com. If you’re curious about crypto, you want to just like drill somebody with questions from this podcast, write them all down and then just grab a time. You can just click book a demo, um, click accept crypto and booking demos, the first option, and just like, get a demo of what it looks like to accept crypto.

And just one of our, our, our fine account executives. Um, even like a one-off support question, let’s say you’re a nonprofit already accepting crypto. Even if you don’t use us just support the giving block. Just shoot over a note. If you have a question about something you’re operating a wallet that you opened with, like Greg and accounting, you’re like, this is a disaster.

You can start there. Hopefully we can be helpful. Um, then how you can help us. If you are a nonprofit services company and you want the crypto option or API is electric, you can plug it in. It makes it really easy. And then just leverage our support networks. You know, if the turnover on your team and do a crypto expert with.

Obviously not the top priority. [00:52:00] Um, and if you are a nonprofit crypto user, anyone else who wants to partner with us do something outside of using our solution that involves crypto philanthropy, journalists, et cetera, just hit us up. We’ll get you whatever data we can or collaborate on a fundraiser together or whatever it might be, where we’re down to dope that we’re rooting for your

George: success.

We love how you were turning so much cryptocurrency into social impact.

Pat: Best of luck. Thanks so much good luck to you, George, for another good year.